Dental Insurance Market: Growth and Trends in Comprehensive Dental Coverage Solutions

Dental Insurance Market: Growth and Trends in Comprehensive Dental Coverage Solutions

Blog Article

"Dental Insurance Market Size And Forecast by 2031

Despite its promising outlook, the Dental Insurance Market faces several challenges, including regulatory barriers, supply chain disruptions, and competitive pressures. However, the resilience of industry leaders and their focus on innovation and adaptability ensure the market’s sustained growth. By analyzing key growth drivers, opportunities, and future scope, this report serves as a critical resource for understanding the industry’s landscape and planning strategic initiatives.

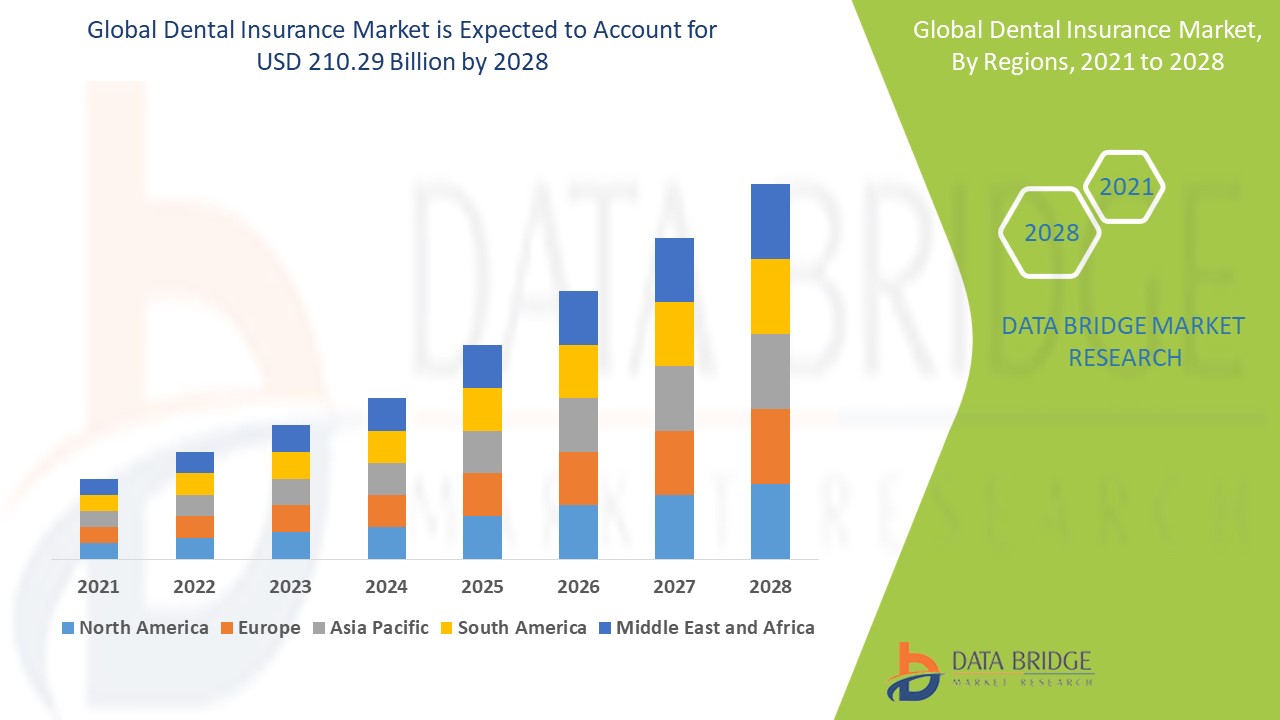

The global dental insurance market size was valued at USD 172.94 billion in 2024 and is projected to reach USD 255.70 billion by 2032, with a CAGR of 5.01% during the forecast period of 2025 to 2032.

Demand for Dental Insurance Market solutions continues to rise, driven by consumer preferences for enhanced efficiency, sustainability, and customization. This growth is underpinned by evolving technologies, innovative product offerings, and strategic collaborations among market leaders. The interplay of these factors creates a fertile ground for revenue generation and industry expansion.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-dental-insurance-market

Which are the top companies operating in the Dental Insurance Market?

The Top 10 Companies in Dental Insurance Market are leaders in their field, known for their strong market presence and innovative solutions. Their success is driven by their ability to adapt to market trends, invest in research and development, and meet customer needs effectively, making them key competitors in the Dental Insurance Market.

**Segments**

- Based on type, the dental insurance market can be segmented into managed care plans, indemnity plans, and others. Managed care plans are further categorized as health maintenance organizations (HMOs) and preferred provider organizations (PPOs). Indemnity plans, also known as fee-for-service plans, offer patients the freedom to choose their dentists and pay for services out of pocket, later reimbursed by the insurance provider. Other types of dental insurance may include direct reimbursement plans or discount plans, offering varying levels of coverage and reimbursement schemes.

- Geographically, the dental insurance market can be segmented into regions such as North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. Each region exhibits unique market dynamics, influenced by factors such as regulatory frameworks, prevalence of dental issues, disposable income levels, and awareness about oral health.

**Market Players**

- Some of the key players in the global dental insurance market include Delta Dental, MetLife, Cigna, Aetna, UnitedHealthcare, Guardian Life, Humana, Ameritas, Anthem, Sun Life Financial, and Blue Cross Blue Shield. These companies offer a range of dental insurance products and services to individuals, families, and employers, catering to diverse needs and preferences in the market. They compete based on factors such as network size, coverage options, premium pricing, customer service quality, and digital innovation to enhance user experience and accessibility.

For more insights and comprehensive market analysis on the global dental insurance market, visit: https://www.databridgemarketresearch.com/reports/global-dental-insurance-marketThe global dental insurance market is experiencing significant growth driven by various factors such as increasing awareness about oral health, rising disposable income levels, and the prevalence of dental issues among the population. As dental care costs continue to rise, more individuals are seeking insurance coverage to mitigate the financial burden associated with dental treatments. This trend has prompted insurance companies to offer a wide range of dental insurance products and services to cater to the diverse needs of consumers.

Managed care plans, including HMOs and PPOs, are popular choices among individuals looking for cost-effective coverage with a network of dentists. These plans offer comprehensive preventive care and treatment options, encouraging policyholders to maintain good oral health through regular check-ups and cleanings. On the other hand, indemnity plans provide flexibility for patients to choose their dentists and services, albeit with higher out-of-pocket costs. Other types of dental insurance, such as direct reimbursement plans and discount plans, appeal to individuals seeking alternative reimbursement schemes and coverage options.

From a geographical perspective, the dental insurance market in North America dominates due to the presence of key players like Delta Dental, MetLife, and Cigna. The region's well-established healthcare infrastructure, high disposable income levels, and awareness about oral health contribute to the market's growth. In Europe, countries like the UK, Germany, and France witness steady demand for dental insurance, driven by favorable regulatory frameworks and increasing focus on preventive care. The Asia-Pacific region is emerging as a lucrative market for dental insurance, supported by a growing middle-class population, rising healthcare expenditures, and improving access to dental services. In Latin America and the Middle East and Africa, the market is poised for growth as governments and insurance providers collaborate to address the unmet dental care needs of the population.

Key players in the global dental insurance market are investing in digital innovation to streamline operations, enhance customer experience, and improve accessibility to services. Technologies such as telemedicine, mobile apps, and online portals enable policyholders to conveniently manage their insurance coverage,**Market Players**

- Aetna Inc (U.S.)

- Allianz (Germany)

- AFLAC INCORPORATED (U.S.)

- AXA (France)

- Ameritas Mutual Holding Company (U.S.)

- Delta Dental Plans Association (U.S.)

- Cigna Healthcare (U.S.)

- MetLife Services and Solutions, LLC (U.S.)

- HDFC ERGO General Insurance Company Limited (India)

- Humana (U.S.)

- United HealthCare Services, Inc (U.S.)

The global dental insurance market is witnessing substantial growth fueled by factors such as increasing awareness about oral health, growing disposable income levels, and the prevalence of dental issues worldwide. Escalating dental care costs have led to a surge in demand for insurance coverage as individuals seek financial protection against expensive treatments. This trend has prompted insurance providers to offer a wide array of dental insurance products, ranging from managed care plans like HMOs and PPOs to indemnity plans that offer flexibility in choosing dentists and services. Other types of dental insurance, such as direct reimbursement plans and discount plans, cater to those seeking alternative reimbursement schemes and coverage options.

In North America, the dental insurance market holds a dominant position due to established players like Delta Dental, MetLife, and Cigna. The region's robust healthcare infrastructure, high disposable incomes, and focus on oral health contribute to its market leadership. In Europe, steady demand for dental insurance is witnessed in countries like the UK,

Explore Further Details about This Research Dental Insurance Market Report https://www.databridgemarketresearch.com/reports/global-dental-insurance-market

Key Insights from the Global Dental Insurance Market :

- Comprehensive Market Overview: The Dental Insurance Market is experiencing significant growth, driven by technological advancements and increasing global demand.

- Industry Trends and Projections: Trends like automation and sustainability are shaping the market, with projections indicating continued growth over the next few years.

- Emerging Opportunities: There are emerging opportunities in green technologies, digital solutions, and under-served regional markets.

- Focus on R&D: Companies are investing heavily in R&D to innovate in areas such as AI, IoT, and sustainable product development.

- Leading Player Profiles: Key players like Company A and Company B lead the market through their strong product offerings and global presence.

- Market Composition: The market is fragmented, with a mix of established players and emerging startups targeting various niches.

- Revenue Growth: The Dental Insurance Market is seeing steady revenue growth, fueled by both consumer and commercial demand.

- Commercial Opportunities: Key commercial opportunities include expanding into emerging regions, digital transformation, and forming strategic partnerships.

Get More Reports:

https://dbmrbusinessinsightscom.wordpress.com/semiconductors-and-electronics-pioneering-innovation-in-the-digital-age/

https://researchword.wordpress.com/comprehensive-market-research-and-future-outlook-of-the-semiconductor-and-electronics-industry-trends-opportunities-challenges-and-growth-drivers-in-a-rapidly-evolving-technological-landscape/

https://dbmrmarketresearchcom.wordpress.com/the-evolving-pharmaceutical-market-innovations-challenges-and-strategic-growth-opportunities/

https://dbmrmarkettrendsdotcom.wordpress.com/market-research-paper-medical-devices-industry/

https://dbmrmarkettrendscom.wordpress.com/oncology-market-research/

https://dbmrmarketresearchcom.wordpress.com/semiconductors-and-electronics-market-driving-innovation-in-a-digital-era/

https://dbmrmarkettrendsdotcom.wordpress.com/market-research-paper-oil-gas-and-energy-sector/

https://dbmrmarkettrendscom.wordpress.com/pharmaceutical-industry-market-research/

https://dbmrmarkettrendsdotcom.wordpress.com/pharmaceutical-market-research-trends-challenges-and-opportunities/

https://dbmrmarkettrendscom.wordpress.com/semiconductors-and-electronics-market-research/

https://dbmrmarkettrendsdotcom.wordpress.com/market-research-paper-semiconductors-and-electronics/

Data Bridge Market Research:

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Email:- [email protected]" Report this page